Today, the A-shares fell as expected by 2735, which was like a bucket of cold wa

Hello everyone, today is September 9th, 2024, and the Chinese stock market has just closed for the morning session. As expected, the A-shares declined by 2735 points today, which is like a bucket of cold water being thrown on everyone. Do you know why? Will it continue to fall? Please watch carefully and patiently, and I will explain in three minutes for everyone to understand.

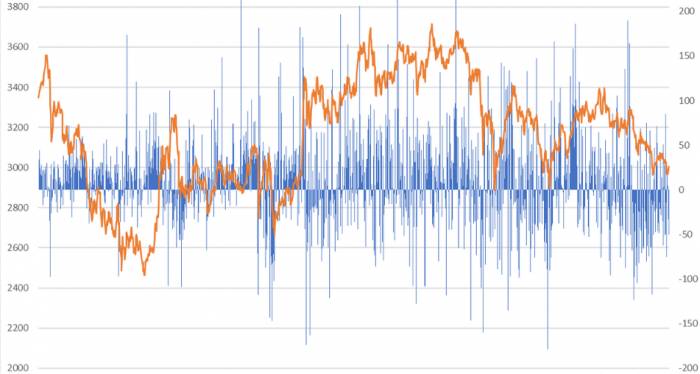

Firstly: Last week, I repeatedly mentioned that the A-shares had not finished adjusting and would at least reach around 2738 points. Moreover, I mentioned that the global stock markets would continue to adjust, and if they fell, the A-shares would follow suit. So today, the A-shares opened lower as expected, with the lowest drop reaching 2735 points. The volume was reduced by 340 billion in half a day, with over 3000 stocks falling and 2000 rising, including 47 stocks hitting the daily limit up and 18 hitting the daily limit down. The main force funds had a net sale of 12.2 billion. The A-shares have continued to fall to 2735 points as expected.

Secondly: Today's A-shares are like another bucket of cold water being thrown, with the market falling incessantly and continuing to drop for four months, and today it continued to open lower with a drop of more than 25 points. Do you know why?

The first reason is that the Asia-Pacific stock markets have all dived. The Nikkei 225 index once opened lower by more than 3%, the Taiwan Weighted Index once opened lower by more than 2.3%, and both the Hang Seng Index and the Hang Seng Tech Index opened lower today by as much as 2%. The Asia-Pacific stock markets have all plunged today.

The second reason is that last Wednesday, the US ADP data was already below expectations, and last week the S&P 500, a major US stock index, did not set a new historical high. The S&P 500 index and benchmark stocks like Nvidia have basically formed a large M-top, triple top pattern.

A few months ago, Warren Buffett had already taken the initiative to focus on cash flow. So last Friday, the US non-farm payroll data was below expectations, and the US stock market dived across the board. Therefore, it is in line with expectations that the global stock markets continue to fall, and it is also in line with expectations that the A-shares continue to decline.

Secondly: Looking at today's A-shares market, it is also like a bucket of cold water being thrown. Apart from the sudden heavy benefits over the weekend, such as the permission to establish wholly foreign-owned hospitals, which is beneficial to the immunotherapy and private hospital sectors, and the pharmaceutical sector has exploded across the board, the rest are basically only locally active. However, today's market is quite weak.

The A-shares market is quite weak at present, specifically as follows. Public transportation, coal mining, oil extraction, oil processing, gold, construction machinery, aluminum, lead-zinc, minor metals, household appliances, thermal power generation, construction engineering, water transportation, steel, gas supply and heating, transportation equipment, banking, telecommunications operations, road and bridge, components, insurance, real estate, and many other industry sectors have all declined. Basically, banks and high dividend stocks have fallen across the board as expected.

Thirdly: So the question arises, the A-shares have fallen to 2735 points as expected, will they continue to fall?

Firstly, this morning, both the Shanghai 50 and the CSI 300 fell by more than 1%, and the Shanghai Composite Index fell by nearly 1%, reaching a low of 2735, which is close to the golden section of 0.191.Secondly, today the micro-cap stock index rebounded with a 0.8% increase, while the ChiNext Index and the Zhongzheng 1000 experienced a slight decline, with the latter showing a noticeable drop but not a significant one. This also indicates a lack of strength in the rebound.

Furthermore, technically, the Shanghai Stock Exchange 50 Index (SSE 50) gapped down today, already breaking below the golden ratio of 0.191. The CSI 300 Index also gapped down and pierced through the golden ratio of 0.191. The STAR 50 Index, despite a high opening, fell back and remains in a downward trend, with no signs of a halt in sight.

Therefore, the A-shares continued to decline to 2735 today, which is the short-term support at the golden ratio of 0.191. However, the likelihood of it not holding up is relatively high, as the market gapped down today and the heavyweight indices continue to fall. Hence, it is probable that the A-shares will further decline, with the 2700 point level becoming a critical defensive battle.

Comments