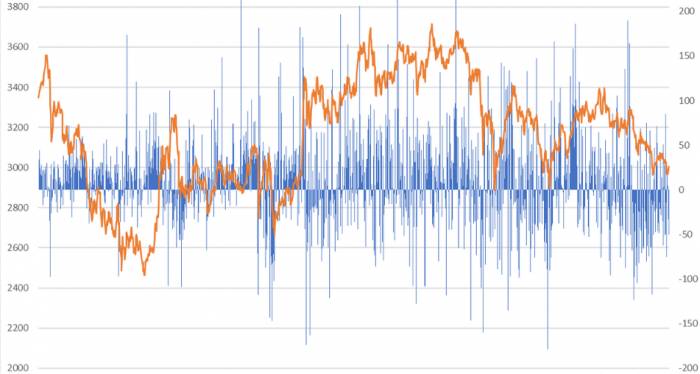

Before going public, they earned 2.878 billion, but after going public, they los

JingHe Integrated Circuits, a company that has taken the art of financial face-changing to the extreme.

From 2020 to 2022, JingHe Integrated Circuits saw its operating income grow from 1.512 billion yuan to 5.429 billion yuan and then to 10.051 billion yuan, a sixfold increase in just three years; during the same period, its net profits turned from a loss of 1.258 billion yuan to a profit of 1.729 billion yuan and then to 3.045 billion yuan, not only reversing its losses but also demonstrating an extremely strong ability to generate profits.

Note that JingHe Integrated Circuits achieved a net profit margin of 30.3%!

However, what no one expected was that as soon as the company went public, raising nearly ten billion yuan through its IPO, it then experienced a dramatic change in performance. In the first three quarters of this year, JingHe Integrated Circuits' operating income was 5.017 billion yuan, a year-on-year decrease of 40.93%; its net profit was 31.99 million yuan, a year-on-year decrease of 99%; and its non-IFRS net profit was -125 million yuan, turning directly into a negative figure.

Before the IPO, the company's operating performance was far ahead, but immediately after going public, the performance changed drastically. Especially the non-IFRS net profit, which was 2.878 billion yuan in profit in 2022, but in the first three quarters of this year, this figure turned into -125 million yuan.

One might ask, isn't this change in performance too fast?

Let's briefly explain.

JingHe Integrated Circuits belongs to the semiconductor industry, established in May 2015, mainly engaged in 12-inch wafer foundry business, and is the third largest in Mainland China and one of the top ten wafer foundries globally. Therefore, benefiting from the huge domestic market demand, as well as rapidly improving process and production capacity levels, JingHe Integrated Circuits has gained favor in the capital market.

In terms of fundraising, in the 2023 A-share IPO fundraising ranking, JingHe Integrated Circuits raised 9.97 billion yuan, ranking third after HuaHong Company and XinLian Integrated Circuits.

To be frank, on a global scale, our semiconductor industry does not have a significant competitive advantage, so it requires substantial policy and financial support to make up for the gap.However, there is significant controversy surrounding this company, especially regarding its gross margin.

From 2020 to 2022, the gross margin of Integrated Circuit (IC) Foundry was -8.57%, 45.13%, and 46.16%, respectively; in the first three quarters of this year, this figure rapidly declined to 18.62%.

Let's make a comparison.

From 2020 to 2021, the gross margin of IC Foundry increased rapidly, significantly higher than comparable peer companies; however, in the first three quarters of this year, this figure declined rapidly and was significantly lower than comparable peer companies.

So the question arises, why is there such a large fluctuation in gross margins among wafer foundries? Why, among the leading companies, does IC Foundry's gross margin far exceed the other two companies?

Some might ask, is it because the third company has a higher level of technical expertise?

To answer this question, let's look at another set of data.

IC Foundry primarily provides wafer foundry services for process nodes of 150nm, 110nm, and 90nm. Taking the first half of 2023 as an example, the wafer foundry revenue for 90nm was 1.477 billion yuan, accounting for 49.72%, and the revenue for 110nm was 936 million yuan, accounting for 31.52%.

This means that IC Foundry mainly makes money from 90nm and 110nm!

But what about SMIC (Semiconductor Manufacturing International Corporation)?SMIC's wafer foundry business revenue from processes of 90nm and below accounts for over 60%, with 40/45nm technology revenue contributing 15%. In other words, compared to SMIC, JCET does not hold an advantage.

To add, whether it's SMIC or JCET, the gap compared to TSMC is very significant, yet JCET's gross margin is less than 7 percentage points lower than TSMC's. One might ask, is this reasonable?

Note, this is not the end.

According to the prospectus data, as of the end of 2022, JCET's main business has issued 316 patents, with patents spread across regions such as Mainland China, Taiwan, the United States, and Japan.

However, there is a set of data that is quite astonishing.

As of the end of 2019, JCET's main business had 42 invention patents; by the end of 2020, this number had risen to 71, with many of these invention patents transferred from the company's second-largest shareholder, Powerchip Technology.

This means that the vast majority of the invention patents were applied for in a rush after the company entered the IPO advisory period!

While this approach can be understood, the issue lies in the fact that even if JCET has over 300 patents, what about SMIC and Huahong? The former has more than 10,000 invention patents, and the latter has more than 4,000.

Thus, when all these factors are considered together, it increasingly feels that JCET is quite "unusual."

Comments