Translation in English: Foreign capital has consecutively sold off nearly 200 bi

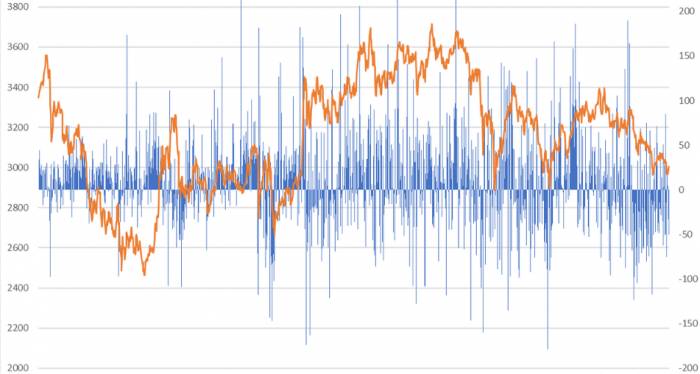

The selling trend of northbound capital is truly despairing. Last week, foreign capital experienced a slight outflow for three days, leading us to believe that the trend of foreign capital outflow had eased. However, this week, foreign capital has been significantly selling off for three trading days. On Monday alone, nearly ten billion was sold in the morning session, causing the A-shares to plunge dramatically. Yesterday, foreign capital's net selling for the whole day exceeded 5 billion, and today it exceeded 9.5 billion, with a temporary sell-off exceeding 10 billion during the session. At present, it seems that the buying by foreign capital last week and the acceptance by domestic capital in the first two days of this week might have been a gamble on policy expectations. After the economic work conference concluded yesterday, funds directly cashed out, and today both domestic and foreign capital are selling off. Since domestic capital is also cashing out, the deep V-shaped recovery seen in the first two days is gone, leaving only a continuous weakening trend. The Shanghai Composite Index has once again fallen below the 3,000-point mark.

In fact, the tone of the conference was in line with expectations, and one could discern positivity and urgency from it. However, the market was looking for stimulus in real estate, especially from foreign capital, which focused solely on real estate and not on the so-called high-end manufacturing. Without seeing any relevant statements, foreign capital mindlessly sold off.

Since early August, northbound capital has consecutively sold nearly 200 billion, with the duration and intensity of the selling setting historical records. Such resolute and decisive selling even leads to suspicions of liquidating positions. Previous experiences have become invalid, and no one can predict when foreign capital will stop selling. Foreign capital still holds nearly two trillion in positions, and it's likely that profits have been wiped out. If they decide to cut their losses, the extent of further selling is unpredictable. This uncertainty is a form of deterrence, causing holders of core assets like the Mao Index and Ning Index to be anxious, and active funds will continue to avoid heavyweight stocks. As a result, heavyweight stocks will continue to experience extreme sell-offs, as evidenced by the Shanghai 50 leading the decline today, with the liquor sector starting to be targeted.

The current A-share market has little to do with fundamentals; it's mainly about when the capital side can reach a new balance. We have always emphasized to everyone that A-shares are at historical lows in terms of index points, valuations, and sentiment, but for a rise, we must have the "east wind," which is the incremental capital. Among the incremental capital, foreign capital is the most flexible; they buy when they are optimistic and sell when they are bearish, unlike public funds that are subject to various restrictions. When they buy, they can offer daily "billion-yuan subsidies," but when they sell, it can last from August until now.

Looking at the Shanghai 50 index, we believe the market is overly pessimistic. The various pessimistic grand narratives are more a form of hindsight bias after a prolonged period of decline, rather than foresight. The short-term economic downturn can amplify the pessimism about long-term trends. We reiterate that in extreme market phases, we should listen less to grand narratives and trust common sense more.

Finally, a brief look at the market: as of the close, the Shanghai Composite Index fell by 1.15%, the ChiNext Index fell by 1.66%, the Hong Kong Hang Seng Index fell by 0.89%, and the Hang Seng Tech Index fell by 1.18%. The total turnover in the two markets shrank to 0.76 trillion, with northbound capital net selling at 9.59 billion.

By industry, sectors such as food and beverages, consumer services, real estate, petroleum and petrochemicals, and power equipment and new energy led the decline.Today, lithium carbonate futures closed at the upper limit across the board. Is this because after the tightening of A-share regulations, some funds have shifted to the futures market for speculation?

Last night, the U.S. released the November CPI, which was in line with expectations. The year-on-year growth rate of the U.S. core CPI in November remained the same as in October, and the month-on-month growth rate rebounded, indicating that the inflation stickiness in the U.S. service industry is strong, and subsequent inflation may not fall quickly. However, the market has priced in the expectation of the Federal Reserve's early rate cut quite fully.

For the Federal Reserve, it is necessary to manage market expectations well. If the market is too optimistic, leading to a rapid decline in U.S. Treasury yields, borrowing costs will also decline quickly, and the economy will rebound. In addition, a significant rebound in the stock market will increase the wealth effect for residents, and their spending will also increase, making it more difficult for the economy to cool down and for inflation to come down. This will, in turn, reinforce the expectation of tightening. It depends on the Federal Reserve's stance on Thursday. If the desire for a soft landing of the U.S. economy is much stronger, and controlling inflation is much more important than a soft landing, then it may be necessary to suppress market optimism.

Comments