Foreign capital is shorting RMB assets! The A-share market is gearing up for ano

Last night, Federal Reserve officials took a dovish stance, causing the yield on the U.S. 10-year Treasury to fall below the 4.3% threshold, and the U.S. dollar index to break below the 103 mark. Today, the offshore RMB exchange rate soared past 7.12, which should have been a significant positive development. However, both A-shares and Hong Kong stocks plummeted today. A-shares are now impervious to good or bad news; they've been falling inexplicably for three days this week, dropping on both negative and positive news. Hong Kong stocks previously responded positively to U.S. Treasury yield movements, but today they surprisingly plummeted as well. After a round of checks, the only bearish news seems to be rumors circulating about a deficit not meeting expectations. However, deficits are determined during the Two Sessions, and this year there have been special government bonds issued, so we don't believe these rumors.

The daily drama in A-shares now involves domestic capital selling off at the open to cope with fund redemptions, followed by foreign capital continuing the sell-off, leading to an index that opens low and goes lower. Today, during the session, the SSE 50 Index hit a new low. The SSE 50 Index is closely related to China's economy, which means that the market's expectations for the domestic economy are now more pessimistic than in October, even with the Federal Reserve's interest rate hikes showing a turning point and a flurry of recent real estate policies.

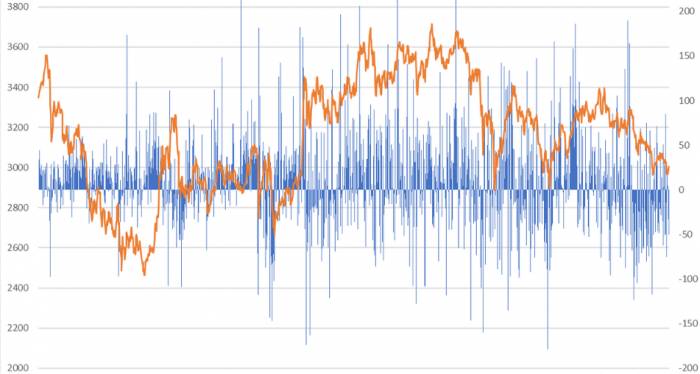

What's most frustrating is that public funds, insurance funds, and other domestic institutions keep saying they are optimistic about A-shares, but as soon as foreign capital starts selling, the stock market has to fall, indicating a lack of support. Although we have judged that "foreign capital is currently the greatest marginal force determining the pricing of A-shares," it is still infuriating and helpless to see the intraday chart of A-shares and the trajectory of foreign capital sales almost identical. The vast A-share market is being dominated by foreign capital, which is lamentable!

Today, the SSE 50 ETF saw a significant increase in trading volume, likely indicating that Central Huijin is buying to support the market bottom. Li Bei mentioned in an article yesterday that the national team's behavior of buying to support the market only when the index is about to break 3,000 points does not help to reverse the pessimistic sentiment in the stock market. Foreign capital has been selling from September to November, totaling nearly 200 billion, but there is still over 1 trillion, which is the greatest suppression of bullish sentiment. Only by completely resolving the issue of foreign capital selling can the offensive be sounded. Li Bei's solution is for the national team to announce a complete hedge against the outflow of foreign capital, which is a similar view we provided in our analysis of foreign capital before the National Day holiday.

We believe that the macro turning point for the global stock market has already emerged. The reason why A-shares continue to fall is due to issues in the micro-fund structure, and the problem of a vicious cycle of market liquidity has reappeared.

Next, let's look at specific news:

Last night, Federal Reserve Governor Waller stated that he is "increasingly convinced" that the Fed's interest rate policy is high enough to bring U.S. inflation back towards the FOMC's 2% target. He pointed out that if efforts to reduce inflation continue to make progress, the Fed may consider cutting interest rates in the coming months, and bond traders are increasing their bets on the Fed cutting rates next year.

On November 28, 2023, according to the official website of ChangXin Storage, ChangXin Storage launched the latest LPDDR5 DRAM memory chip, becoming the first brand in China to introduce a self-developed and produced LPDDR5 product, achieving a breakthrough in the domestic market and making ChangXin Storage's product layout in the mobile terminal market more diverse. Stimulated by this news, the A-shares of the ChangXin industry chain surged.Additionally, according to reports from Caixin, industry sources indicate that Samsung has fired the first shot in raising CIS prices, notifying customers of the price increase today. The average increase for the first quarter of next year is as high as 25%, with some products seeing a maximum increase of up to 30%. The products subject to price increases are mainly concentrated in specifications above 32 megapixels. Today, the camera module sector in the A-share market also surged, with shares of Will Semiconductor increasing by more than 4% during trading.

On November 28th, at the Smart World S7 and Huawei All-Scenario Launch event, Yu Chengdong stated that by the end of 2024, Huawei's 600kW liquid-cooled supercharging stations will be deployed in over 100,000 locations nationwide. Stimulated by this news, the liquid-cooled fast charging and silicon carbide concept sectors surged today, with Yonggui Electric's stock hitting the daily limit up.

Lastly, looking at the market, by the close, the Shanghai Composite Index fell by 0.56%, the ChiNext Index fell by 1.06%, the Hong Kong Hang Seng Index fell by 2.08%, and the Hang Seng Tech Index fell by 2.25%. The total turnover of the two markets shrank to 0.77 trillion, with Northbound capital significantly net selling over 5 billion.

Today, the interest rates for treasury repurchase continued to rise in the afternoon, with the GC001 rate reaching a high of 7.7% and the R-001 rate reporting at 7.65%, indicating relatively tight liquidity in the interbank market.

Comments