Translation in English: The Beijing Stock Exchange is booming, with Longzhu Tech

Beijing Stock Exchange (BSE) is on fire.

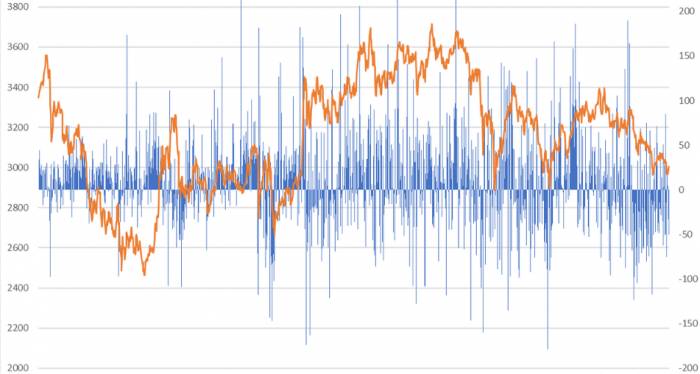

On September 4th, at the opening, the BSE 50 Index surged, rising by more than 7% at one point, with all 217 stocks listed on the BSE turning red across the board.

Just two days prior, the "Opinions on High-Quality Construction of the Beijing Stock Exchange" were officially released, also known as the "BSE Deep Reform 19 Articles". Among them, the capital market's most concerned points are: "Sci-Tech Innovation Board investors can 'one-click' open BSE rights, and clarify the expectation of transferring to the main board, allowing high-quality companies to go public directly through IPO without the need for listing."

In a word, the BSE is expected to expand on both the financing and investment sides!

Encouraged by this positive news, Longzhu Technology immediately hit the 30% daily limit upon opening.

So the question arises, as the first batch of market-making targets on the BSE, and with the title of "the first bamboo product stock on the BSE," is Longzhu Technology worth paying attention to after its stock price has plummeted by 80%?

Longzhu Technology's main business is relatively simple, mainly focusing on the design, production, and sales of bamboo furniture and home products, including cutting boards, turntables, bowls, flower stands, etc., with exports accounting for more than 70%. The company was established in 2010, listed on the New Third Board in 2014; in 2021, after terminating the application for the Growth Enterprise Market and transferring to the BSE.

However, since then, the stock price has entered a long downward channel.

In November 2021, Longzhu Technology's stock price was 21.53 yuan per share; but as of August 31st, Longzhu Technology's stock price fell to 3.84 yuan per share, a drop of 82%, and the company's market value shrank from 3.1 billion yuan to 700 million yuan.

What caused this?On the one hand, it is related to the insufficient liquidity of the North Exchange; on the other hand, it is also directly related to the poor fundamentals of the company! According to the financial reports, Longzhu Technology's sales revenue was 144 million yuan in the first half of this year, a year-on-year decrease of 29.08%; net profit was 3.666 million yuan, a year-on-year decrease of 89.42%; net profit attributable to non-controlling shareholders was 2.401 million yuan, a year-on-year decrease of 92%. Note that the return on equity is only 0.95%, less than 1%.

In terms of profitability alone, Longzhu Technology has returned to the same level as eight years ago, that is, 2015, which can be said to be a serious decline!

Focus on the gross margin.

From 2020 to 2022, Longzhu Technology's gross margins were 34.23%, 31.84%, and 25.42%, respectively, and in the first half of this year, this figure dropped to 18.56%. Under such circumstances, it is understandable that the company's profitability has declined.

So, what logic does this reflect?

The answer is: too much dependence on channels, and the company lacks a moat!

In the semi-annual report, Longzhu Technology specifically mentioned the risk of dependence on a single customer. It is understood that since 2011, Longzhu Technology has started cooperating with IKEA, with sales revenue from IKEA accounting for more than 90%, which means that Longzhu Technology is very dependent on the sales channel of IKEA.

As a result, problems also arise.

Although the deep binding with IKEA is conducive to the increase of the company's sales volume, due to the excessive dependence on a single channel, the company's bargaining power is weak. As a result, when IKEA experiences a decline in sales and a series of store closures, Longzhu Technology, as a supplier, naturally becomes the target of "squeezing".In the final analysis, it all comes down to the lack of a moat for Longzhu Technology.

At first glance, Longzhu Technology is named with the term "technology," but in reality, the extent of this "technology" content is questionable. Because, if bamboo products can be labeled as a technology company, then can other home and furniture companies as well?

On one hand, the application scenarios for bamboo products are not particularly extensive; on the other hand, Longzhu Technology has not established brand recognition in the minds of consumers. Of course, on the flip side, bamboo products are still in a rapid growth phase, and under the requirements of low-carbon and environmental protection, the market demand remains very broad.

However, looking at the current situation, the significant drop in the company's stock price is a reaction to the company's poor fundamentals. It could even be said that if the company cannot quickly turn around its downturn, then the current price-to-earnings ratio of 60 times is still considered high.

Comments