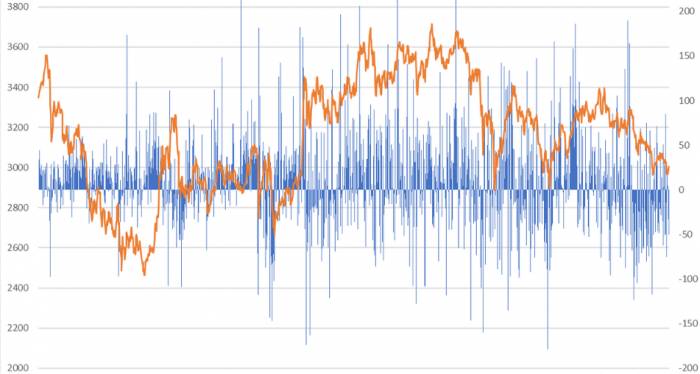

A staggering 72.95% plunge in just three years! Investors "vote with their feet,

In recent years, the market has continued to fluctuate, and currently, no fewer than the funds established around 2021 have seen their performance plummet and their scale shrink dramatically due to factors such as "chasing the rise and killing the fall," leading to a surge in the number of liquidations.

Data from Tonghuashun iFinD shows that since the beginning of September, within just four days, 11 funds have announced the cessation of operations and have entered the liquidation process (counted by the maturity date). The data indicates that among these 11 funds, 7 were established in 2021, with 6 of them being set up around September 2021, having been in existence for about three years.

Among them, the Hengyue Quality Life Mixed Initiated Fund was established on August 31, 2021, and since its establishment, the net value has cumulatively declined by 72.95%, with a cumulative net value of 0.2705 yuan on the last day of operation.

On September 2, Hengyue Fund issued the "Announcement on the Termination of the Fund Contract of Hengyue Quality Life Mixed Type Initiated Securities Investment Fund and the Liquidation of Fund Assets." The last day of operation was August 31, 2024, and the fund entered the liquidation process from September 1.

The reason for the liquidation of this fund is its excessively small scale. The announcement shows that if the net asset value of the fund is below 200 million yuan three years after the effective date of the "Fund Contract," the fund contract will automatically terminate and cannot be extended by convening a fund unit holder's meeting. The effective date of the fund contract was August 31, 2021, and the date when the fund contract was effective for three years was August 31, 2024.

Poor performance is an important reason for the difficulty in the scale growth of this fund. Looking at the changes in the scale of this fund, when it was established in August 2021, the scale was nearly 168 million yuan. In the months following its establishment, the fund shares more than doubled, but then, as the net value continued to decline, the fund also faced continuous redemptions. As of the end of the second quarter of this year, the shares were less than 200 million, and the net asset value was only slightly over 60 million yuan.

In fact, in addition to the Hengyue Quality Life Mixed Fund, there have been several other funds liquidated this year. Choice data shows that as of September 5, a total of 315 public funds have been liquidated this year.

Data from the China Securities Investment Fund Industry Association shows that as of the end of July, the asset management scale of public funds exceeded 31 trillion yuan, with the number of funds exceeding 12,000. However, Choice data shows that currently, more than 4,300 funds have a scale below 200 million yuan, among which there are more than 1,600 mini funds with a scale below 50 million yuan.

"The scale of fund products becoming 'mini' indicates that their positioning cannot meet the needs of the market and investors, and investors are 'voting with their feet,'" said a third-party fund analyst. Mini funds, due to their small scale, find it difficult to effectively allocate assets, which is not conducive to protecting the interests of holders.

In the view of industry insiders, the newly issued funds are mostly replicas of mature or successful products in the market, and there is a need to increase innovative products. Because of this, a large number of products that do not meet the needs of the market and investors will be accelerated to the periphery, becoming mini funds, and ultimately being eliminated.An industry insider stated that against the backdrop of a general decline in profit margins for fund companies, their own company carefully assessed the fixed costs associated with managing these mini funds, as well as the potential impact on the company's costs and revenues. For products that indeed have no market demand and incur higher costs, they may adopt a policy of "cleaning up as much as possible." At the same time, the company is also being more cautious in the layout of future products.

Comments