Two major bearish factors! The Shanghai Composite Index falls below 3200, and Ap

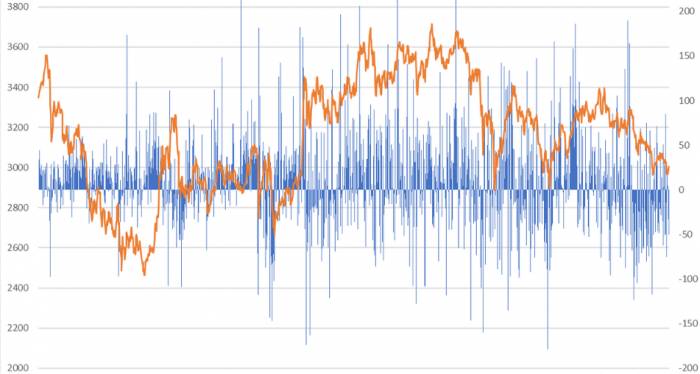

Today, the Japanese stock market opened low and closed high, setting a new record high, while the A-share market, like a jester, opened low and closed even lower, setting a new record low. Today marks the first time since the Spring Festival that the Shanghai Composite Index (SCI) has closed below 3,200 points; on previous occasions, it had only dipped below this level during the session but recovered by the close. The ChiNext Index (CNE) doesn't even need to be mentioned; if it falls a bit more tomorrow, it will break the low point that was established during the Shanghai pandemic last year. Going further back, it would be at the level of June 2020, which means three years of gains have been wiped out, reflecting an extremely pessimistic sentiment.

Let's examine the PE BAND of the ChiNext Index. The earnings per share (EPS) of the ChiNext Index have been on an upward trend since 2019, and the high valuation that was criticized in 2021 has been largely digested by the strong earnings growth over the past two years. Thus, we can observe that even though the earnings of the ChiNext Index have been continuously increasing, its valuation has been on a downward trajectory. As of today's close, the trailing twelve-month (TTM) PE ratio of the ChiNext Index stands at 31.67 times. During the great bear market of 2018, the lowest valuation of the ChiNext Index was around 28 times, and looking at the past decade, it has been in an undervalued range.

Yesterday, a joke went viral, where a new energy fund manager quipped: "What China can't make is high technology, such as AI and chips; what China can make is manufacturing, such as new energy." In 2021, the market discussed new energy with terms like high-end manufacturing and high technology, but now it's just seen as lowly manufacturing, deserving of low valuations.

For so many years, the ecosystem of A-share market, characterized by group buying and high-level speculation, has not changed. In 2019, institutions grouped together to invest in semiconductors; in 2020, they grouped together to invest in liquor and pharmaceuticals; in 2021, they grouped together to invest in new semi-conductor and military industries. Today, they group together to invest in AI and China-specific valuations. Each time, it's a rush to get in, as if they want to pack several years' worth of performance into one year's expectations, and then when it comes time to actually deliver on those performance expectations, everyone starts to run, leaving a mess behind.

Take, for example, yesterday's release of Apple's headset. Based on the information we've seen, as early as February, sellers started digging for stocks and promoting them, with many funds already making several rounds of investments. For instance, Zowee Mechanical and Electrical's stock price nearly doubled this year, starting to rise as early as last June. Then, as the release approached, many institutions began to aggressively hype it, and retail investors followed suit and entered the market. But when the market saw that it did not meet expectations, there was a massive sell-off today, with stocks like Zowee Mechanical and Electrical, Sanli谱, and Shuangxiang Technology hitting the daily limit down.

We can say this outright: with the nature of the A-share market, good news is bad news once it's realized. Even if Apple's headset met expectations, it would have opened high and closed low today. This is because many funds are already positioned in it and will inevitably take the opportunity to cash out on the good news.

Previously, the market had high hopes for Apple's headset, with many institutions touting it as the "VR's iPhone moment." The market expected Apple's headset to become a hit, thereby driving a recovery in consumer electronics. Therefore, today's collapse was not only in the Apple supply chain but also in semiconductor chips, with the entire AI sector plunging. AI has been the mainstay of the market recently, and when AI falls, market sentiment collapses.

Of course, we are not denying the strength of Apple's Vision Pro in terms of technology. However, its price is slightly high, and it is not as revolutionary as imagined. If it sells well later on, the industry chain could still pick up.

Returning to the A-share market, the SCI was on the verge of breaking below 3,200 last week but was given a temporary reprieve by some small pieces of news. However, the management's resolve is stronger than expected, with real estate policies being introduced, but they are far from satisfying the market. Market expectations have fallen again, giving off a sense of despair.By the close, the Shanghai Composite Index fell by 1.15%, and the ChiNext Index fell by 1.70%. The total turnover of the two markets slightly increased to 0.93 trillion, with over 4,500 individual stocks declining and less than 600 individual stocks rising, a truly dismal sight.

Looking at the sectors, only coal, real estate, and building materials saw increases, while electronics, defense, computer, public utilities, and environmental protection led the decline.

Today, we searched around and found no particularly significant bearish factors. The external markets were calm, the yuan did not depreciate, and foreign capital only sold off slightly, indicating that it was entirely domestic capital that drove the market down. The A-shares have been consolidating around 3,200 for two weeks. Consolidation is not the norm; if the market does not receive new expectations and cannot move higher, it will have to come down.

However, even the ChiNext Index has entered an undervalued range, so there is no need for pessimism. During downturns, there will always be many scary stories. Putting aside emotions and sentimentality, the risk-reward ratio of A-shares stands out. Everything is cyclical, and at the bottom, it is even more important to learn to look up at the stars, so as not to regret not buying at the bottom when the market rises in the future.

Comments