Translation in English: What's going on? Nasdaq futures, suddenly plunging strai

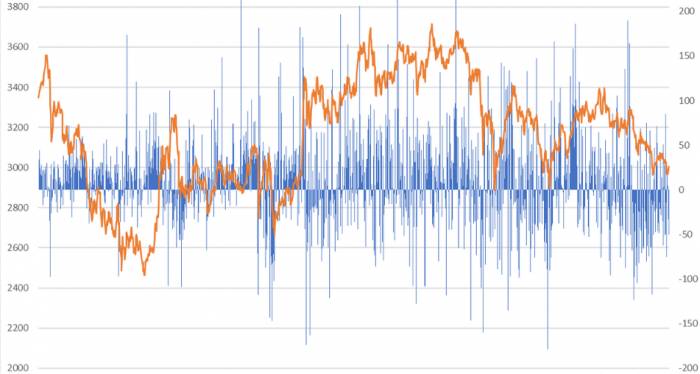

Today, A-shares experienced a rise and subsequent decline, with the Shanghai Composite Index initially returning above the 2800 point mark, only to encounter resistance and fall unilaterally, setting a new low in seven months. The SSE 50, CSI 300, STAR 50, and other stock indices also hit new low levels for this stage. Over 4,500 individual stocks in the two markets fell, with a transaction volume of 544.8 billion yuan.

In the Asia-Pacific market, stock indices in Japan and South Korea also declined.

Additionally, the Nasdaq 100 index futures also showed a steep plunge. In terms of news, the U.S. non-farm employment figures for August will be released tonight. The previous July non-farm data significantly missed expectations.

On the A-share market, sectors such as public transportation, securities, banking, and automotive recycling were relatively active, while sectors like BC batteries, high-speed copper cable connections, folding screens, and storage chips were at the forefront of the decline.

Real-time monitoring data from Wind showed that the automotive and non-bank finance sectors both received net inflows of over 2 billion yuan from main funds, while banking, retail, transportation, and machinery equipment also saw net inflows of over 100 million yuan. Main funds in the pharmaceutical and biological, food and beverage, computer, and real estate sectors, however, saw net outflows of over 100 million yuan.

Looking ahead, Guotai Junan pointed out that in a low-risk preference environment, cash flow is the pricing anchor for industry comparison. Opportunities to lay out in sectors with improved cash flow growth and non-crowded positions should be valued, such as insurance, petrochemicals, chemical engineering, batteries, rail transit, education, and leisure food. The barbell strategy should continue to hold sectors with high-quality profit growth at both ends, such as semiconductors, shipbuilding, automotive parts, innovative drugs, precious metals, electricity, and highways.

East Wu Securities believes that as we enter September, on one hand, the mid-term report performance has been realized, and the risk of performance uncertainty has been released in a phased manner. On the other hand, the U.S. interest rate cut window is about to open, and the global fund rebalancing will help repair the valuation of growth directions. At the same time, strong industrial trend branches such as AI terminals and low-altitude economy will see a dense catalyst of events in September, and the A-share growth sector has entered a time for active layout.

In terms of hot spots, the public transportation concept continued to rise sharply, driven by the wave of autonomous driving. The sector index gapped up at the open and rose, surging nearly 8% at one point during the session. Da Zhong Transportation opened with a daily limit up, setting a new high since November 2015 (adjusted), and Jin Jiang Online also quickly hit the daily limit after opening. Shen Tong Metro and Jiangxi Changyun were among the leaders in gains.

CCID Consulting estimates that the incremental value of the vehicle-road-cloud integrated industry in 2025 will be 729.5 billion yuan, with a compound annual growth rate of 28.8% from 2025 to 2030. The market growth is mainly centered around six areas: automotive intelligent driving hardware and software, intelligent cockpit hardware and software, in-vehicle application software, in-vehicle communication units, vehicle terminal products, and innovative application services.

Everbright Securities stated that the commercialization of autonomous driving passenger services has been put on the agenda. Taxi companies in Shanghai, such as Da Zhong Taxi and Jin Jiang Taxi, have carried out demonstration operations of intelligent connected unmanned taxis with relevant partners. As the scope of autonomous driving passenger services gradually expands from pilot cities to the whole country, taxi companies are expected to cooperate with autonomous driving technology companies in operations, thus opening up new tracks.The news of the merger between Guotai Junan and Haitong Securities not only stimulated the strength of securities firms but also ignited the imagination for state-owned enterprise (SOE) reform concepts. Today, multiple SOE concept stocks such as Hainan Haiyao and Lansheng Shares opened with a daily limit up, while Changchun Yidong and Dongli Xinke also experienced vertical lifts during the trading session, ending with a strong daily limit up.

Galaxy Securities stated that compared to the overall A-share market, central SOEs possess characteristics of strong profitability, lower valuations, and higher dividend yields, highlighting their long-term investment value. In terms of thematic investment opportunities, in line with the spirit of the 20th Central Committee's third plenary session and the new round of central SOE reform measures, the investment value of central SOEs in the fields of national security, infrastructure construction, and technological innovation is expected to gradually increase.

Comments