Translation in English: Three major bearish factors! Shanghai Composite Index fa

Offshore Renminbi Plunges Below 7.2

Last week, the central bank's interest rate cut and Blinken's visit to China sparked market expectations for management's commitment to stable growth and improved Sino-US relations, leading to a violent rebound in low-positioned sectors such as A-share consumer goods, pharmaceuticals, and new energy. The renminbi also appreciated significantly. However, no further positive news emerged over the weekend, and the growth-stabilizing policies discussed at the State Council meeting have not yet been implemented. Although the LPR was reduced yesterday, the cut for the five-year term was lower than market expectations.

Additionally, this year's 618 sales event saw neither Alibaba nor JD.com release their performance reports. Daniel Zhang stepped down as CEO of Alibaba, and Jack Ma suggested a return to Taobao, which essentially reflects a perception of downward economic pressure in China and a lack of confidence in consumption upgrades. Instead, there is a shift towards the battleground of consumption downgrading, initiating a fierce internal competition, which will undoubtedly intensify competition among platforms.

All of these factors have led to a renewed decline in market confidence in economic recovery. Over the weekend, Goldman Sachs revised down its 2023 China GDP forecast from 6% to 5.4%; UBS announced on Tuesday this week that it has lowered its 2023 GDP forecast to 5.2%; Nomura last week stated that it has reduced its 2023 GDP forecast from 5.3% to 5.1%, and its 2024 forecast from 4.2% to 3.9%; Barclays' GDP forecast for 2023 is 5.2%.

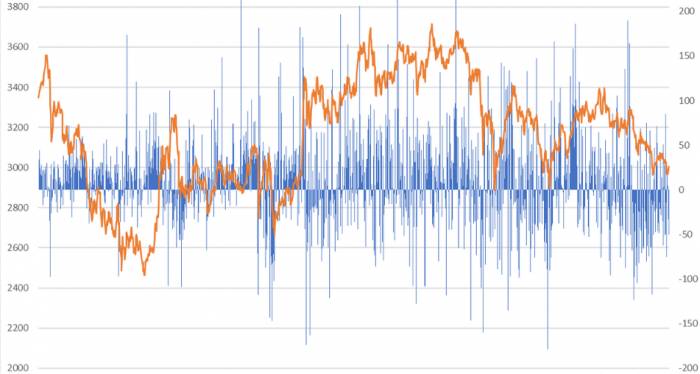

This week, A-shares have fallen for three consecutive days, and yesterday's Hong Kong stock market plummeted. The offshore renminbi exchange rate broke below 7.18 without the US dollar strengthening, and today it continued to plummet, breaking through 7.2 and setting a new low. The management has shown restraint, choosing not to stimulate the economy with excessive liquidity, which may be beneficial for high-quality development, but this is not what the market wants, and this week's sharp decline is a venting of market sentiment.

AI Plunges

Last night, two major bearish factors emerged for AI: Kunlun Wanwei's "Jia Yueting-style" share reduction and Inspur Information's warning of a possible negative growth in mid-term performance. Today, Kunlun Wanwei's stock price plummeted at the opening and was suspended at noon, leading to a sharp decline in the gaming sector, while Inspur Information led a crash in computing power.

However, we believe that today's AI crash, on the surface, is due to the bearish factors of Kunlun Wanwei and Inspur Information, but in essence, it is because of excessive short-term gains and high sector congestion, as we warned a couple of days ago. AI has entered an emotional speculation stage, and this kind of relay game will lead to a significant correction once funding cannot keep up. Additionally, as we enter July, it is the second-quarter performance window, and many AI stocks have no actual performance, so funds will inevitably cash out in advance to avoid potential pitfalls.Pharmaceutical Plunge

Today's most significant decline was in AI, followed by CRO and CXO sectors, with significant drops for companies like Kanglong Huacheng, WuXi AppTec, KaiLaiYing, and MedeXcell. The slowdown in order growth is the reason behind today's CXO plunge. According to reports, as of May 31, 2023, WuXi Biologics had a total of 613 projects, with 25 new integrated projects added in the first five months of 2023, compared to 47 new projects in the first four months of 2022, a clear halving year-on-year. Going further back, in 2020-2021, WuXi Biologics added 103 and 156 new projects respectively. If this downward trend continues, WuXi Biologics' new project additions this year will be far less than in the past.

New Energy Vehicle Purchase Tax Exemption

The Ministry of Finance and two other departments announced the continuation and optimization of the new energy vehicle purchase tax exemption policy. New energy vehicles purchased between January 1, 2024, and December 31, 2025, will be exempt from vehicle purchase tax, with a maximum exemption of 30,000 yuan per new energy passenger car; for new energy vehicles purchased between January 1, 2026, and December 31, 2027, the vehicle purchase tax will be halved, with a maximum tax reduction of 15,000 yuan per new energy passenger car.

Encouraged by this positive news, NIO's shares on the Hong Kong stock market once surged by more than 5%, and Li Auto's shares once increased by more than 3%. However, the A-share new energy vehicle sector opened high and closed low, which is disappointing. The A-share market is really frustrating, with too much speculative capital, and even good news is treated as a reason to cash out.

Specifically, by the close, the Shanghai Composite Index fell by 1.31%, once again breaking below 3,200 points, and the ChiNext Index fell by 2.62%. The total turnover of the two markets slightly shrank to 1.02 trillion yuan, with more than 4,100 stocks falling. Northbound capital slightly net sold 641 million yuan, and today's market was entirely driven down by domestic capital.

Looking at the sectors, only public utilities rose, while media, computers, communications, electronics, and social services industries led the decline.

Our evaluation of the A-share market can be summed up in three words - utterly rotten. The speculative nature of the A-share market has not changed over the years. Due to the lack of a short-selling mechanism, when a sector is hyped, other investors cannot profit from short-selling and can only join the long side, leading to a continuous influx of funds. The entire market revolves around one sector, while other sectors are bled dry. Then, when this sector adjusts, it will drag the market down, and investors who did not participate in the speculation will also suffer. It's like missing out on the feast but not escaping the beating. In the end, when the bubble bursts, it leaves a mess. Today's AI will follow the path of the past new energy sector, and it might even be worse, as at least the new energy sector can show tangible performance.

Comments