The bull market is born in skepticism! The A-share market has seven consecutive

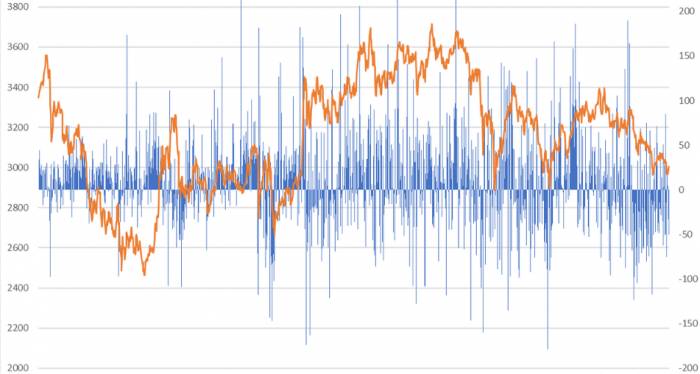

Unconsciously, the Shanghai Composite Index has already achieved seven consecutive days of gains. In just two weeks from before to after the holiday, it has risen from 2,600 points to nearly 3,000 points. The article "Squeezing Short" written by Li Bei before is quite appropriate now. With such a rise, the first thing everyone must acknowledge is that the bear market has ended, and then we must consider whether a bull market is brewing.

Yesterday, I analyzed for everyone that due to the end of the liquidity crisis in A-shares, the national team is no longer buying actively, but the management has also imposed unprecedented restrictions on short selling. First, quantitative trading was regulated, and then today it was rumored that major institutional investors are prohibited from reducing their holdings at the opening and closing of each trading day. Judging from the trend of these two days, this rumor might be true. A-shares opened strong today, only to be sold off around ten o'clock. It is important to note that the first and last half hours of the opening and closing are usually the most active trading times. Now that institutions are restricted from net selling, the game has to change.

After two months of selling off at the beginning of the year, the A-shares have been cleared quite thoroughly, and the bottom has actually been picked up by the national team. The national team is basically locked in, so this part of the chips is very stable. If there is an increase in funds, it is easy to pull up. From this perspective, we can understand the volume reduction and rise after the holiday, and it was only in the last two trading days that there was a turnover of chips, and the actual selling volume is not large.

Whether the subsequent trend can be reversed depends on the sustainability of the incremental funds. We have always emphasized that foreign capital is the most flexible force among the incremental funds, and the overlap between foreign capital and public funds' heavy stocks is high. Foreign capital purchases can revitalize the funds' heavy stocks.

We believe that insurance funds, foreign capital, and retail investors are the key incremental funds for the subsequent period. Today, the coal sector has reached a historical high, and behind it is the purchase by absolute return funds represented by insurance funds. As for foreign capital, its view of Chinese assets has undergone a huge change. The attitude of foreign capital has shifted from pessimistic to neutral or even positive. Today, the net purchase of northbound funds exceeded 3.6 billion, and the net purchase since January 22 has been nearly 50 billion.

Then there are retail investors. It can be seen that the financing balance of the two cities has begun to rebound, indicating that as the market warms up, the sentiment of retail investors is also rising, and retail investors are increasing their positions. The financing balance is 20 billion away from the high before the holiday, and there is a large space here.

Finally, the largest incremental funds are actually the large amount of money printed by the central bank in the past two years. This money is either lying in bank deposits or in the bond market. If subsequent policies are proactive enough to promote economic recovery, these funds that have been deposited in the financial market are also expected to enter the stock market. Of course, this is a bit far-fetched, and if it really reaches this point, it would be a big bull market.

Let's take a look at today's heavy news:Nvidia reported its earnings in the early hours today, with fourth-quarter revenue of $22.1 billion, exceeding analysts' expectations of $20.41 billion; data center revenue for the fourth quarter was $18.4 billion, surpassing the expected $17.21 billion; the adjusted gross margin for the fourth quarter was 76.7%, higher than the anticipated 75.4%; the company forecasts first-quarter revenue to be around $24 billion, with a variation of no more than 2%, which is above the analysts' expectation of $21.9 billion.

Nvidia's robust performance and guidance, coupled with the State-owned Assets Supervision and Administration Commission's (SASAC) emphasis last night on accelerating the layout and development of the intelligent industry and the construction of a batch of intelligent computing power centers, have today sparked a surge in AI computing power and state-owned cloud-related sectors, with many stocks hitting the upper limit.

The Japanese stock market continues to strengthen, with the Nikkei 225 index rising by more than 2% today, breaking through the 39,000 point mark to set a new historical high. Indeed, it is a historical high, surpassing the 38,915 point historical closing high set at the peak of the bubble economy at the end of 1989, marking a milestone in Japan's economic recovery from the bubble burst.

However, Japan's economy has contracted for two consecutive quarters, falling into a technical recession, and its nominal GDP has been overtaken by Germany. The Japanese stock market has embarked on a major bull market amidst the recession, which makes one wonder, what is there to fear for the A-share market?

In reality, last year, only the A-shares and Hong Kong stocks performed poorly, while global stock markets were reaching new highs. If we look beyond Chinese assets, the global stock market is in a bull market era. Everyone says that the AI revolution is no less significant than the previous industrial revolutions, and productivity will leap forward once again. So, with the AI revolution plus the Fed ending interest rate hikes, a major bull market seems inevitable. Looking back at China, although our AI may not match that of the United States, it can be considered second to none. Other countries that are not as advanced as us are in a bull market; it doesn't make sense for A-shares not to be in a bull market. The bull market may be late, but it will not be absent!

Finally, a brief look at the market: as of the close, the Shanghai Composite Index rose by 1.27%, the ChiNext Index rose by 0.31%, the Hang Seng Index in Hong Kong rose by 1.45%, and the Hang Seng Technology Index rose by 1.75%. The turnover in the two markets shrank significantly to 0.82 trillion, with more than 4,500 stocks rising in the two markets.

Looking at the industry breakdown, sectors such as coal, computers, communications, petroleum and petrochemicals, and media led the gains.

Comments