Translation in English: Great weekend news! Seven departments make a significant

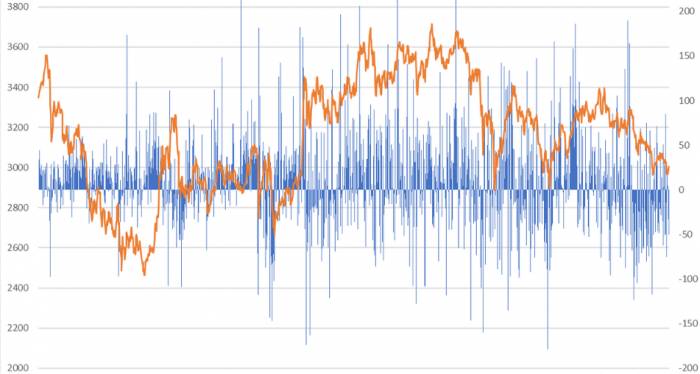

In the past two weeks, due to the significant outperformance of U.S. employment and inflation data, hawkish statements from Federal Reserve officials, and geopolitical conflicts driving up crude oil, copper, and other commodities, market expectations for a Fed rate cut have cooled significantly. The yield on the U.S. 10-year Treasury bond soared, and global stock markets weakened, especially technology stocks which experienced consecutive sharp declines, also dragging down AI technology stocks in the Chinese A-share market. Value styles clearly outperformed growth styles.

However, this week, the environment characterized by high interest rates, high inflation, and high risk aversion improved. The manufacturing PMI of Germany, the UK, and other European countries, as well as the U.S. manufacturing PMI, all fell short of expectations, indicating that the U.S. economy did not continue to strengthen, and the U.S. Q1 GDP also missed expectations. Concerns about geopolitical conflicts in the Middle East eased, and market risk appetite improved. Of course, most importantly, Microsoft and Google's earnings and guidance exceeded expectations, leading the AI sector to counterattack. This week, global stock markets rebounded to varying degrees, with technology stocks being the strongest. The Hang Seng Tech Index in Hong Kong stocks rose by more than 13% in a single week, which is rare in history. The Nasdaq in the U.S. rose by more than 4%, and the ChiNext Index in A-shares rose by nearly 4%. However, as of this week, the annual gains for the Shenzhen Component Index, the ChiNext Index, and the Hang Seng Tech Index in Hong Kong stocks are still negative.

Looking specifically at A-shares, the Shanghai Composite Index rose by 0.76% this week, the Shenzhen Component Index rose by 1.99%, and the ChiNext Index rose by 3.86%. In terms of market value style, micro-cap and small-cap stocks were significantly stronger than large-cap stocks. This week was also a week of style rotation, with the previously strong large-cap value style pulling back and the previously weak small-cap, growth style rebounding.

By industry, this week, the computer, non-bank finance, beauty care, electronics, and telecommunications industries led the gains, while the coal, petroleum and petrochemicals, steel, non-ferrous metals, textiles and apparel, and banking industries led the declines. It can be seen that the industries leading the declines this week were the ones that led the gains this year, and most of the industries leading the gains this week are still in the red for the year.

Heavyweight weekend news:

Due to Google and Microsoft's Q1 earnings and subsequent capital expenditures exceeding expectations, both A-shares and U.S. stocks sparked a major AI trend on Friday. Nvidia rose by 6.18%, and Google surged by more than 10%, with its market value breaking through two trillion U.S. dollars. Driven by technology stocks, the Nasdaq in the U.S. rose by more than 2% on Friday.

According to the website of the Ministry of Foreign Affairs of China, on April 26, 2024, Wang Yi, a member of the Political Bureau of the CPC Central Committee and Minister of Foreign Affairs, held talks with U.S. Secretary of State Blinken in Beijing. Based on a comprehensive exchange of views, the two sides reached a five-point consensus. It was mentioned that both sides announced that the first meeting of the China-U.S. intergovernmental dialogue on artificial intelligence will be held.Domestic AI also has positive news: Beijing has released a plan requiring full-stack independent control of smart computing infrastructure hardware and software products by 2027. Companies that purchase independently controllable GPU chips to provide intelligent computing power services will be supported at a certain percentage of their investment. The China Academy of Information and Communications Technology has released the country's first automotive large model standard, which will accelerate the intelligent interaction and service intelligence in automotive scenarios. The Tsinghua team's domestic "Sora" has become popular! The visual effects are on par with OpenAI, and the length can reach up to 16 seconds.

Today, at the 2024 Zhongguancun Forum, Lin Jianhua, Deputy Director of the Beijing Municipal Development and Reform Commission, announced the "Beijing Municipal Measures to Accelerate the Leading Development of General Artificial Intelligence Industry." It is proposed to strengthen basic research in the industry, support innovative entities in tackling core technologies, and include the best in the municipal scientific and technological research and development plan, with a maximum support of 30 million yuan. For projects included in the national major strategic tasks, the maximum reward is 100 million yuan.

The most discussed topic over the weekend was the depreciation of the yen and the sharp rise in Hong Kong stocks this week. Chen Guo from CITIC Construction Investment mentioned that the reason for the suppression of Hong Kong stocks in the second half of last year was that capital in the Asia-Pacific region mainly flowed to Japan, leading to a severe lack of liquidity in Hong Kong stocks and low transaction volumes. The most classic trend was that Hong Kong stocks did not rise when U.S. Treasury bond rates fell in October last year and the expectation of interest rate cuts was strong at the beginning of this year, while the Nikkei continued to hit new highs.

This year, after the Bank of Japan raised interest rates, the yen further depreciated. Recently, it has been continuously hitting a 34-year low, and Asia-Pacific funds have begun to flow back to AH assets, and foreign institutions have also started to be bullish on Hong Kong stocks. Chen Guo mentioned that the yen has depreciated beyond expectations, eroding the returns on investments in the Japanese market, leading to a decline in the attractiveness of the Japanese market. Recently, the Nikkei index has plummeted, and foreign capital has begun to flow back to the Hong Kong stock market.

Seven departments jointly issued the "Implementation Details of the Automobile Replacement Subsidy," and according to the calculation of securities firms, this round of policy covers about 18 million existing passenger cars, which is expected to bring a considerable increase.

The real estate sector surged on Friday mainly due to policy expectations. On April 28, Chengdu announced a major news, canceling the housing purchase restriction! Nanjing also released a big move a few days ago: you can settle with a house, and family members can follow! According to incomplete statistics from Securities China reporters, since this year, many places such as Nanjing, Jinhua, Hefei, Wuxi, Zhoushan, etc., have relaxed their settlement policies.

Comments