Breaking positive news! The ChiNext board surges over 3%, signaling the start of

The rise may be delayed, but it will not be absent! Amid the global stock market rebound triggered by the continuous plunge in U.S. Treasury yields last week, A-shares lagged significantly, but this week A-shares finally made up for the lag and caught up. Foreign capital rarely bought for three consecutive trading days, and the selling trend since August may be reversed. The turnover of the two markets once again broke through one trillion, the ChiNext Index rose by more than 3%, basically recovering the October decline, and the Hong Kong stock market continued to soar, with the Hang Seng Technology Index rising by more than 4%.

Today's trend basically followed the script we gave on Friday and Sunday. In our Friday review, we proposed that if the non-farm employment data and unemployment rate continued to be lower than expected, the expectation of a peak in U.S. Treasury yields would form. In fact, that night, U.S. Treasury yields and the U.S. dollar index plummeted, and U.S. stocks and European stock markets rebounded across the board. On Sunday, we combed through the weekend's good news and pointed out that in the face of the inflection point of U.S. Treasury yields, this macro factor, domestic capital should replenish positions. If foreign capital continues to buy, then domestic and foreign capital will resonate, and we can be more optimistic about the strength of the rebound. We should pay attention to the return of institutional pricing power, such as public mutual funds' heavy consumption, pharmaceutical, new energy, and electronics sectors.

In addition, on Friday, the China Securities Regulatory Commission made a significant statement, one of which was "supporting leading securities companies to optimize and strengthen through mergers and acquisitions and other means, to build first-class investment banks." The mergers and acquisitions of leading securities companies were mentioned again, and the enthusiasm for the speculation of aircraft carrier-level brokers was ignited.

Today at the opening, foreign capital bought more than 4 billion in ten minutes, and the securities sector strengthened, driving the index higher. However, the "stamp duty" tombstone line is still fresh in everyone's memory, so a lot of money quickly cashed out, and the index also rose and fell back, with turnover increasing. But as we said, in front of the expectation of the reversal of the macro pricing factor of U.S. Treasury yields, in order to avoid missing out, institutions will definitely replenish positions. Subsequently, domestic capital entered the market, foreign capital continued to buy, and the index steadily rose after bottoming out.

As of the close, the Shanghai Composite Index rose by 0.91%, and the ChiNext Index rose by 3.26%, recovering the 2000 point mark; the Hong Kong Hang Seng Index rose by 1.71%, and the Hang Seng Technology Index rose by 4.09%. After four trading days, the turnover of the two markets once again broke through one trillion, and the net purchase of northbound funds was 5.273 billion, with more than 4,600 stocks rising. However, today's most fierce was the South Korean stock market. Over the weekend, it announced a comprehensive ban on short selling of stocks until next June, and today the South Korean Composite Index soared by 5.66%.

Looking at the industry, media, electronic equipment, non-bank finance, computers, real estate, and other industries led the rise, while coal, petroleum, public utilities, agriculture, forestry, animal husbandry, and other industries fell. Today's A-shares were mainly driven by the good news of the sharp drop in U.S. Treasury yields, with growth stocks performing well, while the more defensive coal, oil, banking, and other value sectors became blood bags.

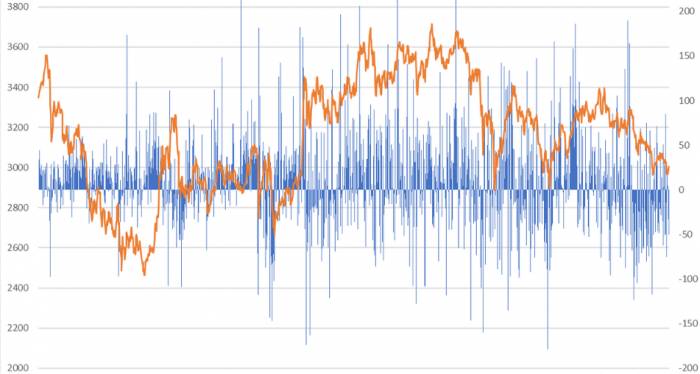

Looking back at our analysis of A-shares from before the holiday to now, we have been talking about four things: domestic policy, U.S. ten-year bond yields, incremental funds, and northbound funds. Grasping these four words also grasps the core logic of the rise and fall of A-shares. We summarized the articles we wrote in these two months into several judgments and shared them in today's pre-plate "Gudong Investment Research" (as shown in the figure below). We hope everyone will watch carefully, which will help to recover at the end of the year.Let's discuss three key points:

Firstly, regarding foreign capital. In August, foreign capital sold off due to risks in real estate and local debt. In September, policies were introduced for real estate and local debt, leading us to believe that foreign capital would cease selling. However, this did not happen, and we later realized that the reason for the sell-off had shifted to U.S. Treasury yields. Consequently, we made a judgment that foreign capital would only return when the yield on the U.S. 10-year Treasury note peaked. Last week's inflow of foreign capital confirmed our judgment.

Looking back at the A-share market, China's economy had already stabilized in August, yet the A-share market continued to decline until the end of October. There was a divergence between the stock market and the fundamentals, and last week, A-shares also significantly underperformed global stock markets. A significant reason for this was the deterioration of the micro fund structure, with continuous liquidity bleeding in the stock market. Specifically, due to the surge in U.S. 10-year Treasury yields, foreign capital continued to sell, and since foreign capital and mutual funds have a high overlap with heavy-weight stocks, this accelerated the decline in mutual fund net values, leading to a redemption wave and putting institutions in a prisoner's dilemma. The prisoner's dilemma refers to a situation where, upon negative news, there is a rush to sell out of fear of being left behind, and upon positive news, there is a rush to cash in to deal with redemptions.

Recently, the situation of liquidity bleeding in A-shares has been alleviated. On one hand, during the sharp decline, liquidity was provided by the Central Huijin Investment, and social security and insurance funds also increased their positions. These funds can offset the outflow of foreign capital. On the other hand, due to the peaking of U.S. Treasury yields and the phased improvement in Sino-U.S. relations, foreign capital has stopped flowing out and has started to flow in. Therefore, the liquidity of A-shares is expected to return to a healthy positive cycle.

Finally, whether the subsequent rebound is a reversal or not will depend on the incremental funds, and these funds will determine the market style. If foreign capital returns to buying, mutual funds can recover, private equity can dare to increase positions after having profit cushions, public offerings can warm up with ammunition to fight, and once the market warms up, funds from outside the market will also enter. These are the sources of subsequent incremental funds. We cannot see that far ahead at the moment, so we will take it one step at a time. What incremental funds buy will have the greatest elasticity. Assuming the logic of foreign capital buying and mutual funds increasing positions, it is necessary to pay attention to the return of institutional pricing power. Overlooked institutional heavy-weight stocks need attention, such as consumer goods, pharmaceuticals, new energy, and TMT.

Combining the logic of marginal improvement and institutional position (chip structure), we are still optimistic about consumer electronics, pharmaceuticals, new energy (wind power, lithium batteries), intelligent driving, and the robotics industry, which have seen more catalysts today. The institutional position in the consumer goods sector is relatively high, and the room for recovery is smaller, requiring more domestic policy to drive. Today, it has become a blood bag instead.

Before any significant domestic policy is introduced, U.S. Treasury yields and foreign capital are still key factors in determining the market trend. If foreign capital turns to selling, it may become a game of existing shares again. Currently, the yield on the U.S. 10-year Treasury note is hovering at the 4.5% mark, and it may wait for next week's inflation data to decide the trend.

However, we believe that the path to the peak of U.S. Treasury yields is not smooth sailing. The employment data released last week fell short of expectations, partly due to the strike of auto workers. Additionally, if U.S. Treasury yields fall rapidly and borrowing costs decrease, the U.S. economy may warm up again, which will restrict the Federal Reserve from cutting interest rates. Therefore, the peaking of U.S. Treasury yields is something that needs to be repeatedly confirmed.

Comments