After being beheaded and then facing a massive reduction in holdings, Trina Sola

Trina Solar (688599.SH) becomes the last straw that breaks the camel's back for photovoltaics.

On the evening of May 26th, Trina Solar announced that its third-largest shareholder, Xingye Capital, and Xingjing Investment, would respectively reduce their holdings by no more than 5.23% and 0.42% of Trina Solar's total share capital. It should be noted that the actual controller of both companies is Industrial Bank.

As soon as the news broke, Trina Solar's stock plummeted by 16% in an instant.

It is important to note that this is not the first time Xingye Capital has reduced its holdings. According to the 2021 annual report, Xingye Capital held 311 million shares of Trina Solar, accounting for 15% of the total share capital, ranking as the third-largest shareholder of the company; in March 2022, November 2022, January 2023, February 2023, and April 2022, Xingye Capital successively reduced its holdings five times; as of April 27, 2023, Xingye Capital's shareholding was 233 million shares, accounting for 10.37% of the total share capital.

However, compared with the previous reductions, the proportion of Xingye Capital's reduction this time is larger. Moreover, judging by this trend, Xingye Capital seems to be heading towards a complete divestment.

Of course, some people may wonder, Xingye Capital and Xingjing Investment's investment in Trina Solar dates back to 2017, which is not a short period for an investment institution. Moreover, the highest paper return of the two investment institutions once exceeded 20 billion yuan, more than seven times the initial cost. Even though the company's stock price has been halved from its peak, the paper profit after deducting the cost is still over ten billion.

That is to say, whether from the perspective of investment period or investment return, there is no problem with Xingye Capital and Xingjing Investment's reduction itself!

However, if it is linked with the current capital market environment, the act of reduction itself is magnified infinitely.On May 24th, the founder of Longi Green Energy roared, stating that "within the next three to three and a half years, more than half of the photovoltaic (PV) industry manufacturers may be forced to exit the market," which triggered market concerns about overcapacity in the photovoltaic industry chain, causing the stock prices that had just shown signs of stabilization to continue to decline.

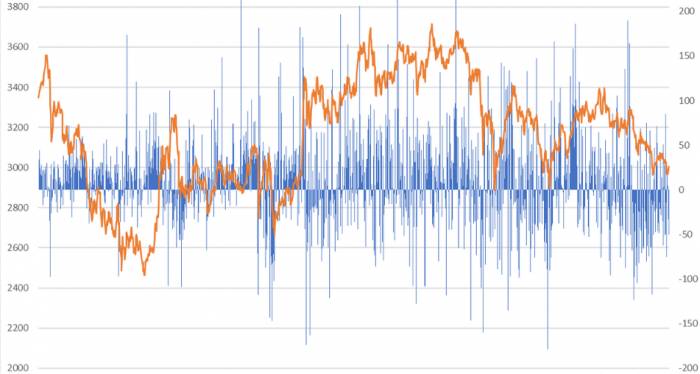

In fact, the prosperity of the entire industry has indeed declined.

On May 26th, according to data from the Silicon Industry Branch of the China Nonferrous Metals Industry Association, the domestic monocrystalline dense material price range was between 125,000 to 130,000 yuan/ton, with a weekly decrease of 10.3%. Note, this is the tenth consecutive week of silicon material price decline.

Regarding silicon wafers, as of now, the prices of silicon wafers from TCL Zhonghuan and Longi Green Energy have already fallen below the quotes at the end of last year. Among them, TCL Zhonghuan recently adjusted the price of silicon wafers twice, with only a one-week interval between adjustments. On May 29th, Longi updated the price of monocrystalline silicon wafers, with an average price reduction of 30.8%. This indicates that, on one hand, the capacity expansion of silicon wafer companies is aggressive; on the other hand, market demand has not met the original expectations.

Note that the photovoltaic industry has a relatively high cyclical attribute, and the high growth of the past few years has led to market divergence on whether this high growth can be maintained in the future.

In addition, it is also directly related to European and American policies and geopolitical factors.

For example, the relevant provisions of the U.S. Inflation Reduction Act stipulate that "from 2024 onwards, batteries and components produced in China will be completely banned"; also, the draft of the European Clean Energy Industry Act intends to restrict the import of clean energy technology and products from China; furthermore, the temporary alleviation of the European energy crisis has slowed down the strong demand for Chinese photovoltaic storage. Moreover, although there is a consensus on the global green energy revolution, there are divergences in the timetable.

In the first quarter of this year, the installation capacity of large-scale ground photovoltaic power stations in the United States was 2.2GWh, a year-on-year decline of 23%, and a sequential decline of 56%. It is clear that as the world's third-largest photovoltaic market and also the market with the highest profit margin, the decline in the U.S. market has also exacerbated market concerns about the prospects of photovoltaic companies to some extent.

In addition, there is another key point.

Unlike the "internal strife" in the vast majority of industries, the photovoltaic industry generally goes global, facing a global market and being more influenced by political factors. Moreover, the essence of global competition can be seen as a struggle for energy, and as photovoltaics are recognized as clean energy, it is destined that this competition will not be smooth sailing.Finally, the extreme polarization of domestic capital preferences has also exacerbated the decline in the stock prices of companies related to the photovoltaic industry chain. When the market is favorable, everyone flocks together in a herd mentality, but once abandoned, they are despised to the extent that even "dogs won't bother with them."

This aspect is not only a pain point for institutional investors but also a nightmare for the vast number of retail investors.

Comments