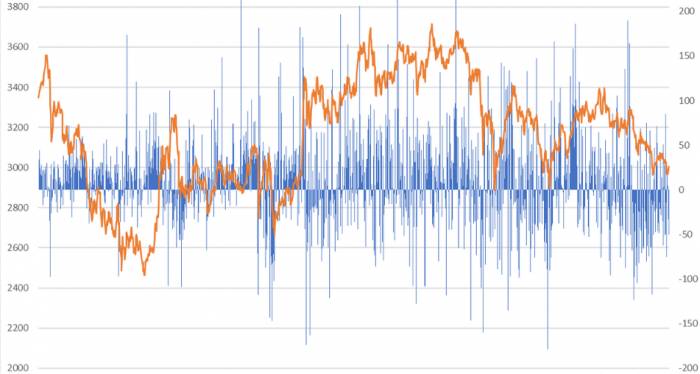

Breaking positive news! The Chinese yuan surges by nearly 500 pips, A-shares mak

Following yesterday's deep V reversal in the A-share market, today's A-shares once again played out the same scenario. As the deadline for the US debt ceiling approaches, safe-haven sentiment led to the dumping of US Treasuries, causing a surge in yields, which in turn suppressed global stock markets (while US stocks continued to rise, only A-shares and Hong Kong stocks were affected as two troubled siblings). Last night, the offshore RMB exchange rate briefly approached 7.1. However, this morning there were reports of progress in the US debt ceiling negotiations, leading to a retreat in the US dollar index and a strengthening of the offshore RMB exchange rate. Additionally, during the trading session, there were rumors of the issuance of special government bonds, but such rumors should not be taken at face value. Nevertheless, with multiple positive factors, A-shares rebounded sharply in a deep V pattern.

Offshore RMB rises by nearly 500 pips

Today, there was finally progress in the US debt ceiling negotiations. According to a report from Caixin, US officials stated that Biden and McCarthy are close to reaching an agreement to raise the debt ceiling for two years and limit spending on most programs except for military and veterans, easing safe-haven sentiment. This morning, the US dollar index weakened slightly.

Furthermore, according to a message on the Ministry of Commerce website, on May 25th, during his visit to the United States to attend the APEC Trade Ministers' Meeting, Minister of Commerce Wang Wentao met with US Secretary of Commerce Raymundo in Washington. Both sides had a candid, professional, and constructive exchange on China-US economic and trade relations and issues of mutual concern. The Chinese side expressed key concerns over US economic and trade policies, semiconductor policies, export controls, and foreign investment reviews. Both sides agreed to establish communication channels to maintain and strengthen exchanges on specific economic and trade concerns and cooperation matters.

The weakening of the US dollar and the easing of China-US geopolitical tensions led to an appreciation of the offshore RMB exchange rate by over 400 pips during today's trading session.

Water sector surges

On May 25th, the Central Committee of the Communist Party of China and the State Council issued the "National Water Network Construction Planning Outline," with a planning period from 2021 to 2035. In the first quarter of this year, the country completed water conservancy construction investments of 189.8 billion yuan, a year-on-year increase of 76.2%. Eleven major water conservancy projects were newly started, with a total investment scale of 47.6 billion yuan, which is six more projects and an additional investment scale of 25.2 billion yuan compared to the same period last year. Previously, the Ministry of Water Resources planned to complete water conservancy construction investments of more than 800 billion yuan nationwide in 2023.

Boosted by this policy利好, the A-share water sector opened sharply higher today and maintained strength throughout the day, with United Water and Qianjiang Water Conservancy hitting the daily limit up. The strength in the water sector also drove the infrastructure sector.BYD, Longi Green Energy lead the collapse in new energy sector

Recently, the new energy sector had just shown signs of stabilization, but an "insider" emerged within the industry. Yesterday, Great Wall Motors reported BYD, and in the past two days, both BYD and Great Wall Motors have seen significant declines, especially BYD, which has damaged the bottom structure that had been hard-earned in recent times.

Additionally, yesterday Wall Street News reported that Li Zhenguo made astonishing remarks at a public event, stating: "The photovoltaic industry has already faced a serious overcapacity issue. In the next two to three years, more than half of China's photovoltaic manufacturers may be forced to exit the market." In fact, the overcapacity in the photovoltaic industry has always been a concern for the market, and now that a major player in the industry has expressed his stance, it will undoubtedly suppress market sentiment.

However, we later saw Longi Green Energy clarify that "they have not obstructed such exchanges." Longi Green Energy's stock price has been on a downward trend since last July, significantly underperforming the photovoltaic sector, with a decline of over 25% this year.

The main story behind the recent surge in photovoltaics was about new technologies. China Merchants Securities believes that the N-type era has begun, with module companies launching N-type modules. However, there is a significant gap in the cell aspect, with some companies leading in technology, taking the lead in mass production, and having more related micro-innovations in reserve. Next year, there may be a new round of differentiation among module companies centered on N-type cells (availability, feasibility, and volume).

Finally, a brief look at the market: as of the close, the Shanghai Composite Index rose by 0.35%, and the ChiNext Index fell by 0.66%. The total turnover of the two markets slightly shrank to 0.82 trillion, but since the Hong Kong stock market was closed today and foreign capital did not participate, it is not considered a shrinkage when including foreign capital.

Looking at the industries, computer, media, social services, communication, and pharmaceutical and biological industries led the gains, while coal, power equipment, beauty care, petroleum and petrochemical, and textile and apparel industries led the declines.

Comments