Breaking news: A sudden positive development! The Chinese yuan surges by 400 poi

Dollar Plunges and Yuan Appreciates

According to Jinshi Data, last night the United States reported a May wholesale sales monthly rate of -0.2%, which was below the market expectation of 0.3%. Fed's Bostic reiterated: believes that no further rate hikes are needed to see inflation return to 2%. Mester: could have raised rates in June, but understands the pause, with interest rate forecasts in line with or slightly higher than the median of the June dot plot.

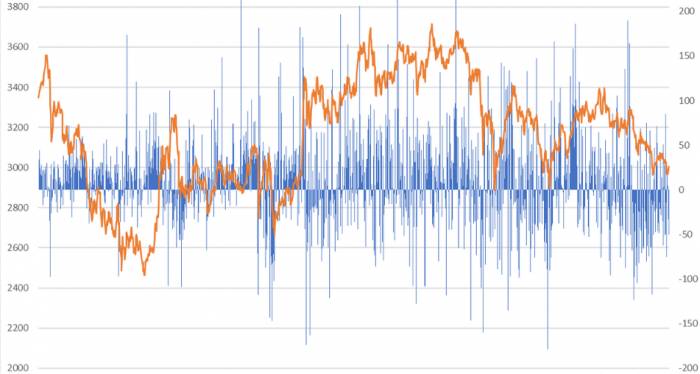

The market has eased its expectations for the Fed, and last night the US dollar index once again broke below the 102 mark, completely erasing the gains from last week's better-than-expected ADP employment report, hitting a new recent low. The yield on the 10-year US Treasury also fell below 4%, and now all eyes are on Wednesday's CPI data. If Wednesday's CPI data continues to be lower than expected, it may not be certain that there will be a rate hike in July. Additionally, the recent depreciation pressure on the yuan has been alleviated, and it appreciated by more than 400 points during today's trading session, breaking through the 7.2 level.

Everything is cyclical; there is no perpetual recession or perpetual recovery. The more prosperous the economy, the more severe the recession after it peaks. After such intense rate hikes by the Fed, it is highly likely that the US economy cannot avoid a recession, and the yuan exchange rate is expected to reach a bottom.

Optimization of the 16 Measures for Real Estate Finance

Last night, the central bank and the National Financial Regulatory Administration issued the "Notice on Extending the Validity Period of Policies Supporting the Stable and Healthy Development of the Real Estate Market," extending the applicable period to December 31, 2024. Financial institutions should implement the requirements of the document, support rigid and improved housing demand according to local conditions, maintain a reasonable and moderate level of real estate financing, increase financial support for the delivery of buildings, promote the market-oriented clearing of industry risks, and promote the stable and healthy development of the real estate market.

However, the real estate sector in A-shares opened high today and then dived. To put it bluntly, this policy was not beyond expectations, mainly focusing on supply-side support. However, the current dilemma of the real estate industry lies in the demand side.

Strengthening Consensus on Carbon NeutralityAccording to Tianfeng Electronics News, the US Department of Commerce issued a decision on July 3rd to revoke the anti-dumping and countervailing duties imposed on solar cell products imported from China since 2012, but this is subject to the condition of meeting specified off-grid small portable crystalline silicon solar components (CSPV).

According to reports, US Special Presidential Envoy for Climate John Kerry is expected to visit China around July 16th to discuss cooperation on climate change with the Chinese side. Climate governance is one of the few areas where China and the US can reach a consensus. Against the backdrop of El Niño, the global consensus on carbon neutrality will be strengthened, which is beneficial for the performance of the new energy sector. However, the current A-share market is still in a state of volume contraction and rotation. Yesterday, photovoltaics led the gains, and today they led the losses. The new energy vehicle sector, driven by intelligent driving, opened low and closed high.

iFlytek's stock soars after earnings report

Yesterday, after the market closed, iFlytek released a preliminary earnings report, estimating a net profit attributable to the parent company of 55 million to 80 million yuan for the first half of the year, a year-on-year decrease of 71% to 80%. The company is expected to achieve operating income of 7.8 billion yuan and gross profit of 3.1 billion yuan for the first half of the year. iFlytek held a research meeting with approximately 900 participants. The company stated that there will be a significant version upgrade for the Spark Cognitive Model on August 15th. Although iFlytek's performance does not match its market value, its stock price soared by nearly 6% during the trading day, closing up 4.98%.

Intelligent driving takes off

Today, the intelligent vehicle sector experienced a surge, with no particular news catalyst observed during the trading session. It might be driven by the significant gains in the new force of car manufacturing in the Hong Kong stock market, with NIO rising by more than 11%, Li Auto by nearly 5%, and XPeng by nearly 10%. There are market rumors that orders for the XPeng G6 are booming.

Today's A-share automotive sector also saw a wave of stock price limits, with Wenchan Shares, Zhejiang World Treasure, Sailis, and Zotye Automobile among others hitting the daily limit.

Since June, the intelligent vehicle sector has been very strong. Although it initially piggybacked on the AI trend, it now shows a trend of developing an independent main line. The intelligent vehicle sector has a large capacity, compatible with both AI and new energy vehicle concepts, and is not rejected by institutions or retail investors.

Logically, on one hand, sales have rebounded in June with strong exports. Data from the China Association of Automobile Manufacturers shows that in June, automobile production and sales completed 2.561 million and 2.622 million units, respectively, increasing by 9.8% and 10.1% month-on-month, and by 2.5% and 4.8% year-on-year, respectively. In June, the production and sales of new energy vehicles completed 784,000 and 806,000 units, respectively, growing by 32.8% and 35.2% year-on-year, with a market share reaching 30.7%.On the other hand, recently there has been a flurry of policies for new energy vehicles and smart cars. Recently, Tesla updated its Full Self-Driving (FSD) algorithm to version 11.4. This upgrade realizes the end-to-end capability of FSD, which includes intelligent driving functions in three domains: highway piloting, urban road piloting, and parking.

As of the close of the A-share market, the Shanghai Composite Index rose by 0.55%, the ChiNext Index rose by 0.81%, the Hang Seng Index rose by 0.95%, and the Hang Seng Tech Index rose by 1.44%. There was a slight increase in trading volume today, but it was only 0.77 trillion, with net purchases of 3.489 billion by northbound capital, marking two consecutive days of net purchases.

Looking at the industry breakdown, sectors such as automobiles, electronics, machinery equipment, communications, and defense and military industries led the gains, while coal, media, public utilities, social services, and retail trade industries led the declines.

Comments